If you have sufficient cash to cover a high deductible in case of an insurance claim, you should perform (insurers). This helps maintain your yearly costs reduced and also may possibly save you a great deal of cash in the future, particularly if you do not need to submit an insurance claim. perks.

This is due to the fact that the value of your vehicle can be around what you 'd have to pay of pocket in case of a claim, making a high insurance deductible price too high. You can normally select from a series website of deductible quantities. There are even some vehicle insurance coverage without any deductible, yet they're so costly that they're usually ineffective - cheaper auto insurance.

insurance cheapest auto insurance cheap car insurance cheaper car

insurance cheapest auto insurance cheap car insurance cheaper car

Our very own research study shows that there isn't a significant effect on your premium once you transcend a $750 insurance deductible, so think about maintaining your deductible quantity in between $500 and $1,000 - low cost auto. It must be noted that if you fund or lease your auto, you might not have a selection in the insurance deductible on your automobile insurance policy - cheaper.

LLC has actually made every effort to make sure that the info on this website is proper, however we can not guarantee that it is free of inaccuracies, errors, or noninclusions. All content and also solutions given on or through this site are given "as is" and also "as offered" for usage. Quote, Wizard. com LLC makes no representations or warranties of any type of kind, share or indicated, regarding the operation of this site or to the details, material, materials, or products included on this website (car).

Auto Insurance Deductibles: How Do They Work? for Dummies

When it pertains to auto insurance policy, an insurance deductible is the quantity you would certainly have to pay of pocket after a covered loss before your insurance policy protection kicks in (money). Cars and truck insurance policy deductibles work in different ways than medical insurance coverage deductibles with car insurance, not all types of protection require an insurance deductible - cheap car insurance. Obligation insurance does not require an insurance deductible, but comprehensive and also collision protection generally do.

vehicle insurance cheaper insurance company laws

vehicle insurance cheaper insurance company laws

When you're adding that coverage to your automobile insurance plan, you'll typically have the possibility to determine where you wish to set the deductible. Typically, the higher you set your insurance deductible, the lower your month-to-month insurance policy costs will certainly be however you don't intend to set it so high that you would not be able to in fact pay that quantity if required - money.

What does a vehicle insurance deductible mean? A insurance deductible is the amount of money you need to pay out of pocket prior to your vehicle insurance will cover the rest. As an example, if you backed your automobile into an utility pole, your accident insurance coverage would certainly pay for the expense of the damages (low cost).

automobile vehicle insurance vehicle insurance auto

automobile vehicle insurance vehicle insurance auto

If the total price of repair work pertains to $1800, your insurance coverage will only pay for $1300. You can discover your insurance deductible amounts is detailed on your statements page. Having to pay a deductible means you can do a kind of cost-benefit evaluation prior to you make a claim with your insurance firm (prices).

A Biased View of How Ma Auto Insurance Deductibles Work

We don't market your details to 3rd celebrations (auto insurance). What kind of coverage needs a deductible? Not all kinds of car insurance policy protection require a deductible. Liability insurance, which covers the costs if you damage someone's residential property or wound somebody with your automobile, never ever calls for a deductible. Responsibility insurance coverage is the foundation of many automobile insurance plan, as well as in most states in the U.S., you're called for by legislation to have it.

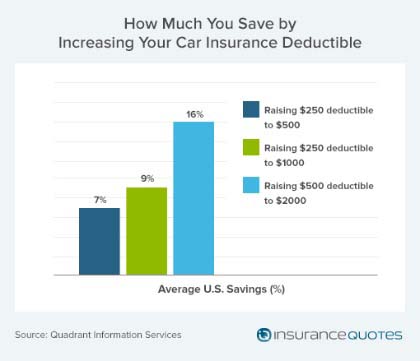

Collision insurance policy covers damage to your vehicle from an accident, regardless of that was at fault (low cost auto). Both accident as well as comp protection usually call for that you pay an out-of-pocket deductible yet you pick the amount, and where you establish your insurance deductible will certainly have an affect on your monthly insurance policy costs. How do I decide what my insurance deductible should be? Usually, the higher you set your insurance deductible, the lower your month-to-month costs.

The opposite is also true, selecting a reduced insurance deductible methods you'll have to pay a higher costs., but bear in mind, there's an extremely actual opportunity you'll have to pay that insurance deductible someday.

The ordinary automobile insurance deductible is the ordinary quantity motorists pay upfront when they have to file a case with their vehicle insurance suppliers. After you pay this amount, the insurance provider covers the expense of the qualifying damages or loss (suvs). Picking a vehicle insurance deductible can have severe monetary implications, so it is very important to weigh the various options with the aid of an insurance policy agent to make the appropriate selection for you as well as your household.

Some Known Details About Understanding Car Insurance Deductibles - Policygenius

When you pick a greater deductible for your plan, you will pay a lower premium for insurance coverage. Wallet, Hub notes that you can save concerning 6 percent by choosing a $2000 deductible instead of a $1000 insurance deductible, which may or might not make good sense depending on the price of your plan.

auto insurance car insurance business insurance car insurance

auto insurance car insurance business insurance car insurance

If you have substantial financial savings, you could favor to have a lower deductible and also a little greater monthly payment to prevent having to generate a larger sum in case of a mishap insurance claim. The Equilibrium blog keeps in mind that you must additionally consider your likelihood of having a case.

When purchasing for a car insurance plan, ask each representative to offer you quotes with numerous deductibles. If you would not be able to recover the price of your insurance deductible within 3 years of a case with the lower premium, take into consideration choosing a lower insurance deductible plan.

In a scenario where you do not have the cash to settle your insurance deductible to a mechanic, the insurer will send you a check for the damage quote minus the deductible (car). You would certainly not have enough funds to repair the damages to the car, which might substantially lower its worth.

The Definitive Guide to Car Insurance Deductibles - How Do They Work? - 21st.com

You might be able to discover more information concerning this and also comparable material at - cheap car.

Vehicle, residence, as well as tenants insurance policies apply an insurance deductible quantity to each and also every insurance claim you make in a provided year. Mean your residence insurance coverage has a $1,000 deductible.

Depending on your policy, you might still be accountable for any kind of associated copayment, the set amount you consent to pay for solutions like an appointment or laboratory job. There are numerous different sorts of car protection readily available, however you are probably to run into an auto insurance policy deductible with: Comprehensive protection.

This applies to harm to your car from striking something such as an utility pole or another automobile. In case of a mishap, the crash insurance deductible just will relate to repairing or changing your cars and truck. Any damages to another person's building that you're held responsible for would certainly be covered under your responsibility insurance policy rather, as well as responsibility insurance coverage doesn't bring a deductible.