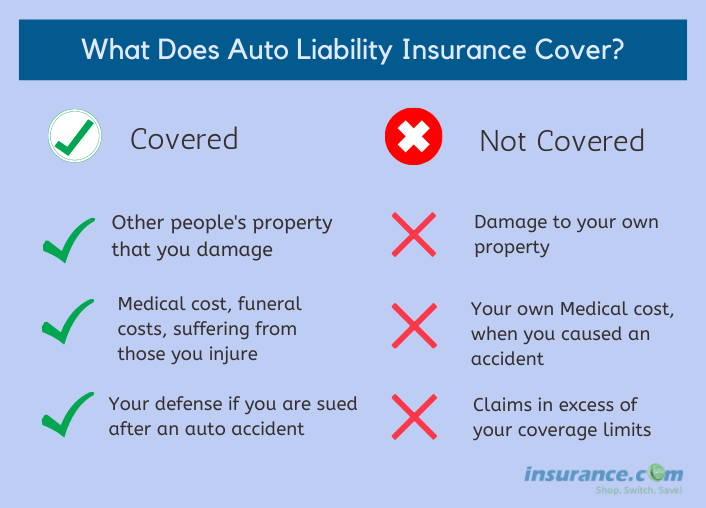

Does obligation insurance cover my vehicle if I am at fault? Obligation protects anybody you struck in a mishap. It does not cover your clinical expenses, damages to your automobile or other losses you experience. You will not only have to spend for the damage to the other person's vehicle, however you will also have to pay for the damage to your own vehicle expense.

insure prices low cost insurers

insure prices low cost insurers

vans cheaper cars vehicle insurance cheap insurance

vans cheaper cars vehicle insurance cheap insurance

When it concerns finding the ideal cars and truck insurance policy for you, it is very important to recognize the different kinds of insurance coverage and also how much you really require. Among your very first decisions will certainly be whether you want liability or full-coverage cars and truck insurance coverage (cars). To streamline, liability insurance coverage covers damages you do to others, while complete protection plans cover both your responsibility as well as building damages to your very own car. cheaper cars.

Liability vs full coverage insurance expense Typically, we located you might conserve almost $1,500 when you get minimal liability protection rather than a plan that consists of comprehensive as well as accident insurance coverage and also greater responsibility limits. liability. These auto insurance rates are based upon a 30-year-old guy and show the cost difference between full protection and also liability. car insurance.

Nevertheless, our sample driver would certainly conserve $2,155 by selecting minimum obligation insurance coverage with Allstate. What is obligation insurance policy vs. complete protection? Obligation insurance will certainly cover damage to other vehicles or injuries to other individuals when you're driving. Full-coverage policies do include liability insurance however likewise additional security to cover damage to your very own car.

cheapest auto insurance cheapest car insurance auto insurance car insured

cheapest auto insurance cheapest car insurance auto insurance car insured

Complete insurance coverage a shorthand name for plans that consist of extensive as well as accident insurance is never required by state regulation, yet your lender might need it if you rent or finance your auto (cheap auto insurance). What is responsibility insurance coverage? is called for by the majority of states and also covers the price of damage and injuries to others you cause in an accident.

The Definitive Guide for What Is Liability Car Insurance? - Business Insider

Obligation coverage is divided right into 2 various parts: and also. will cover the cost of the various other person's injuries if you are at mistake for the accident, up to the policy's limitations - cheaper. Policy limitations typically show two figures: The maximum amount paid per person hurt in a mishap The optimum amount spent for the entire accident Normally, the complete amount is dual the per-person restriction.

The policy limitation for this kind of protection is detailed as a single dollar quantity, which stands for the maximum payout per mishap. If you live in a state that does not require vehicle insurance coverage, like New Hampshire or Virginia, you're still economically accountable for injuries and building damages resulting from an accident. vehicle insurance.

What is full-coverage insurance policy? This term refers to policies that consist of obligation coverage along with (car insurance).

This safeguards the loan provider due to the fact that you'll have the ability to repair the possession that protects the financing (your car). If you have your vehicle outright, you have no obligation to acquire complete protection. However, if you have a newer automobile or one that still has noteworthy worth, full protection might deserve the financial investment to safeguard you versus high expenses after an accident.

If your existing cars and truck deserves even more than the consolidated cost of a full-coverage policy and also insurance deductible, complete insurance coverage might deserve the cash. Say your auto is currently worth $25,000, and also your auto is completed in a crash with a tree. Collision insurance would certainly cover the complete $25,000, minus your insurance deductible.

3 Easy Facts About Car Liability Insurance Explained - Definitions - 21st.com Described

As a basic rule, full coverage costs chauffeurs about $1,000 annually, so those who own valuable vehicles can save themselves from some significant expenditures (suvs). If your vehicle is worth much less than the cost of full coverage, you might desire to select liability-only insurance coverage, as your will be much reduced (insure).

These rates were publicly sourced from insurer filings as well as need to be made use of for comparative purposes only your very own quotes might be various - cheaper car insurance.

Obligation protection is a vital insurance coverage security (cheaper car insurance). What Does Obligation Auto Insurance Policy Cover?

The adhering to expenditures are among the kinds of damages that may be thought about: Medical facility and medical expenses Shed wages Discomfort and experiencing Recovery solutions In-home health care services Responsibility coverage offers crucial protection for chauffeurs and also a lot of states need motorists bring a minimum amount of obligation insurance policy. Most Discover more here states call for vehicle drivers to carry automobile liability insurance policy.

cars accident credit car

cars accident credit car

[Songs] >> SPEAKER: Physical injury responsibility insurance coverage - you might have come across it but what is it? Image this, you're driving to function, en route you get involved in a crash with another car lugging 3 individuals. All of them are hurt. That's what bodily injury responsibility protection is for.

Liability Coverage - Elephant Insurance Things To Know Before You Get This

If you're found responsible for an accident, your web well worth might be at risk. The more properties you have, much more insurance coverage you might want.

For more responses, go to [sonification] What Is Bodily Injury Obligation and What Does It Cover? Physical injury responsibility insurance coverage generally covers the prices related to injuries you created to other individuals, approximately your plan restriction, in a protected crash. Insurance coverage can also pay for a lawful defense if you're demanded that accident. auto.