Policies that just satisfy state minimum insurance coverage demands will be the most affordable. Added protection will certainly cost even more. Why Do Automobile Insurance Coverage Prices Adjustment? Looking at ordinary vehicle insurance coverage prices by age and state makes you question, what else influences rates? The response is that automobile insurance coverage rates can transform for numerous reasons. An at-fault mishap can raise your rate as a lot as 50 percent over the following 3 years. If you were founded guilty of a DUI or carried out a hit-and-run, your rates will go up much more. You don't have to be in an accident to experience rising rates. Generally, auto insurance coverage often tends to get extra expensive as time goes on. Thankfully, there are a number of various other price cuts that you may be able to.

exploit on right currently. Right here are a few of them: Lots of firms provide you the largest price cut for having an excellent driving background. Called bundling, you can get reduced prices for holding more than one insurance policy with the very same business. Homeowner: If you have a residence, you might obtain a home owner price cut from a variety of suppliers.

Obtain a discount for sticking to the exact same company for numerous years. Right here's a secret: You can constantly contrast rates each term to see if you're obtaining the most effective cost, despite having your loyalty price cut. Some can also elevate your prices if it transforms out you're not a great motorist. Some companies provide you a discount for having an excellent credit report

When looking for a quote, it's a good suggestion to call the insurer as well as ask if there are any kind of more discounts that relate to you. Sirijit Jongcharoenkulchai/ Eye, Em, Getty Images Exactly how much you should pay for car insurance coverage differs extensively based on a variety of factors. Geography is normally the most crucial aspect for risk-free chauffeurs with decent credit history, so it assists to understand your state's averages - car insurance. The nationwide standard for vehicle insurance coverage costs has to do with $1621 per year, and there are states with averages much away from that figure in both instructions. Average National Expenses, The total national typical price of cars and truck insurance policy will certainly vary based upon the source.

Car Insurance - Volume 5 - Page 3 - Google Books Result - An Overview

That$1621 a year number comes from Nerd, Pocketbook, while The Zebra puts the typical expenses closer to$1502 annually. Whatever the case might be, you'll probably locate yourself paying even more than $ 100 monthly for auto insurance coverage - cheapest car insurance. When computing national prices, a range of aspects are included.

Besides, several protection alternatives are offered from insurance provider, as well as the ordinary number needs to reflect one of the most usual kind of protection. In this case, the national cost figures determine plans that consist of liability, comprehensive, and accident insurance policy in enhancement to state-mandated insurance coverage like personal injury security as well as without insurance vehicle driver coverage. Usually, the minimum insurance will cost regarding$676 per year, which is nearly$1000 much less than the nationwide average each year. While these averages can be useful for obtaining a concept of what insurance policy expenses, your individual elements have one of the most influence on the premium rates you'll obtain. Average Insurance Coverage Level, Normally, individuals often tend to choose even more insurance coverage than the minimum that's lawfully called for. Typically, full insurance coverage will cost not even$900 per year. North Carolina and also Idaho are likewise remarkable for using budget-friendly full coverage. One of the most expensive state for insurance is Michigan, and its typical premiums are much beyond the national standard. insurers. For full coverage in Michigan, you'll be paying over $4000 per year, though there are initiatives to lower this rate. Factors Influencing Your Costs, How much you should be spending for your costs is mainly influenced by differing individual elements in enhancement to your specific area.

cheaper car liability insurance company cars

cheaper car liability insurance company cars

cheaper car insurance low-cost auto insurance suvs dui

cheaper car insurance low-cost auto insurance suvs dui

While any element can suggest just how much of a risk you will be to guarantee as a motorist, one of the most important elements are normally the very same throughout all insurance coverage firms, though there are exemptions - vehicle insurance. Minimum state-required protection will constantly be the most economical, however if you intend on offering your auto at a later day, comprehensive coverage might be a personal need.

Age: Age plays a large role in just how much your premium is. If you're over the age of 25 with a tidy background, your premiums will mostly be the Click here very same for years.

This is because of the sheer opportunity of entering a crash being boosted contrasted to individuals that don't drive as much. This is only true if you go with comprehensive and crash insurance policy. insurance. Considered that many people prepare to offer higher-end designs in the future, however, extensive and also accident insurance may be a need. Credit report: Your credit rating rating indicates exactly how dependable

Not known Details About Car Insurance - Volume 5 - Page 3 - Google Books Result

you are when it pertains to paying back fundings. Some states, nonetheless, forbid business from utilizing credit report scores as a variable for premium rates. Just how much you must spend for cars and truck insurance policy relies on a number of aspects all working together. As a result of this, there is no one-size-fits-all response to your vehicle insurance policy needs. Bear in mind to go shopping about and also compare quotes to make sure that you can discover the finest prices for the insurance coverage your certain driving routines require. You may be able to discover even more information regarding this and similar material at. insured car. 55 in 2018(one of the most recent year covered in the record ). Nonetheless, your own costs might vary. The quickest means to figure out exactly how a lot an automobile insurance coverage would cost you is to utilize a quote calculator tool. Enter your postal code below to get cost-free, immediate insurance coverage quotes from a few of the most effective cars and truck insurance firms in your area.

Bundling: Packing your home and also auto insurance coverage typically leads to premium discount rates. You can additionally save money for guaranteeing several cars under the same policy. Paying in advance: The majority of insurance companies use a pay-in-full discount rate - low cost. If you have the ability to pay your whole premium at the same time, it's commonly a more economical option.

Our technique Because consumers depend on us to provide unbiased and precise information, we created a comprehensive score system to create our positions of the finest vehicle insurance coverage business. We accumulated data on loads of auto insurance providers to grade the business on a wide variety of ranking elements - affordable car insurance. Completion outcome was a general rating for each and every company, with the insurance companies that racked up one of the most points topping the listing.

Protection: Business that offer a selection of selections for insurance policy protection are much more likely to satisfy consumer needs. Consumer Experience: This score is based on volume of complaints reported by the NAIC and customer contentment ratings reported by J.D.

The smart Trick of State Auto Insurance That Nobody is Discussing

Having the right information appropriate info can make it easier to simpler an accurate car precise cars and truckInsurance policy

In virtually every state, a minimum of some quantity of vehicle insurance is required by legislation to support the wheel. Being legally called for, vehicle insurance policy is vital to keep you secured from the financial burden of an array of bad things that can take place in, around, and also to your vehicle.

prices vehicle car insurance cheaper cars

prices vehicle car insurance cheaper cars

We'll damage down exactly how we price Lemonade Cars and truck plans, so you can obtain the facts and also get the coverage you need with confidence. One of the most straightforward means to get a sense of just how we price Lemonade car insurance coverage is by looking for coverage. It's fast, easy, and also basic to compare. automobile.

Picking a higher insurance deductible will usually cause reduced costs, since it implies you would certainly be in charge of even more of the initial expenses in case of an accident. What the price of Lemonade Auto covers If you wish to take a deep dive into all of the insurance coverage types provided by Lemonade Cars and truck, we have actually got you covered here - cars.

If you want finding out more about a policy with Lemonade Cars and truck, the simplest way to discover your coverage optionsand what you 'd payis by using for a quote. automobile. It's quickly, very easy, as well as also a little enjoyable.

What Is The Cost Of Car Insurance For 16-year-old Driver? - Way - The Facts

car credit score cheapest auto insurance insurance companies

car credit score cheapest auto insurance insurance companies

As any person that has ever owned a vehicle knows, driving is costly in even more means than one as the globe responded to Russia's intrusion of Ukraine with permissions as well as financial boycotts, gas prices all over the world were one of the very first to take a hit. Along with the first purchase of a cars and truck an additional not-so-easy task offered supply chain disturbances and a worldwide semiconductor shortage and also climbing expense of gas, maintenance as well as insurance policy are 2 other unavoidable prices that can create a serious dent on one's purse - car."Families' transport budget plans are already under considerable monetary strain amidst the highest possible inflation in 40 years, and also virtually every facet of driving is obtaining more costly," Bankrate expert Sarah Foster said in a declaration.

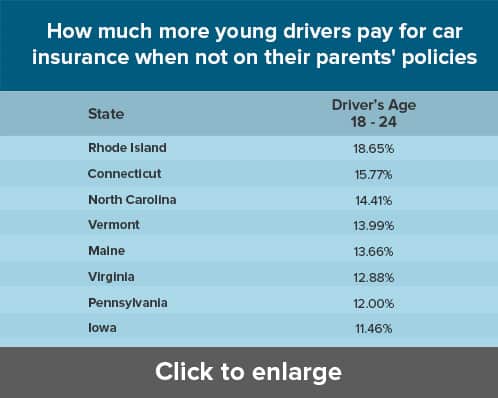

Maine, on the other hand, has very low-cost insurance policy protection at just $876 a year. Having Kids (Who Drive) Is Even Much More Costly, Normally, these kinds of basic calculations don't claim much offered that so much about just how much one pays for auto insurance policy depends on points like car usage and driving background adding a teenager motorist to an auto will certainly send your insurance coverage up by an average of $2,081 a year.

Also a solitary speeding ticket will certainly enhance typical coverage to $2,138 while those with a tidy document will certainly pay $1,771. Who Will be Able to Manage to Continue Driving? Coupled with the increasing cost of gas and also regular inflation, these numbers are certainly disconcerting a recent survey of 2,000 Americans discovered that the typical one stressed about cash six times a day.

According to current numbers from the American Mass Transit Association, 45% of all Americans do not have access to reliable public transport near their home."The complete impact of inflation on chauffeurs is yet to be seen, however rising cost of living moving tends to stay in motion: Insurance provider are reacting to greater fixing and devices expenses by boosting their costs, emphasizing the importance of searching if you stay in among these costlier city locations," Foster stated.

It seems crazy to buy anything without knowing what you're going to pay for it, yet that's what a great deal of us do when it concerns auto insurance policy. Besides, lots of people acquire an auto first as well as only after that begin thinking concerning vehicle insurance coverage and also just how much they'll pay.